|

1. STRENGTHS

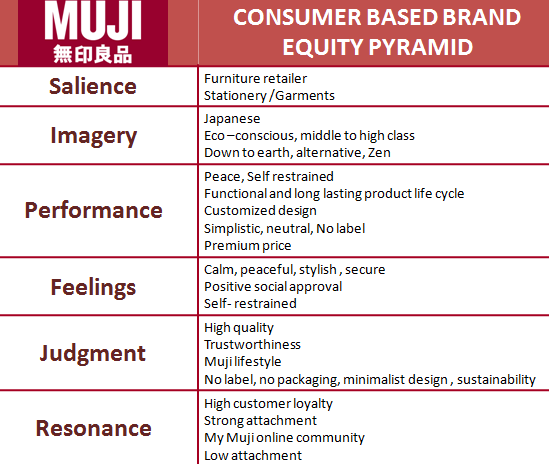

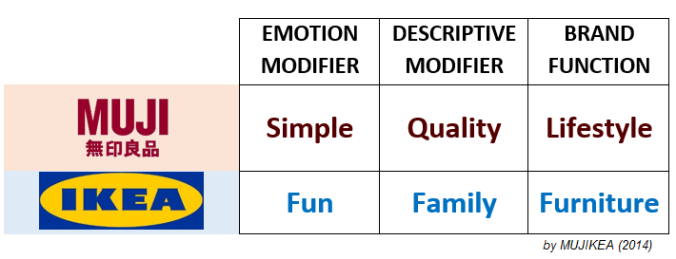

1.A. UNIQUE EXPERIENCE: Table 1 in the Lovemark post has uncovered the special sensorial pleasurement that MUJI has to offer to its customers and this is a ‘hidden’ strength of MUJI that builds brand personality. The smell of cedar, the sounds of light instruments strummed add to this feature and the impact of all senses on the shopping experience at MUJI should be underestimated.

1.B. “Made in Japan” QUALITY: some of the common expectations of any Japanese brand is packaging, attention to detail and quality. MUJI chose to focus its energy into quality at the expense of frills and this a desired value most of its customers appreciate. Their product range is timeless, smart, adaptable and moreover lasts long to survive decades in any household type for any person. As a result their products from the late 90s still exist until today. Most MUJI furniture are imported from Japan, even those found in Paris, France.

1.C. STRONG IDENTITY: Respect for nature, reducing waste, recycling, keeping it simple, lasting quality, anti-branding and peace amidst chaos… these are all the messages MUJI instills in its brand and they permeate city life through city retail to target Urbanites who desire just that. The manufacturing process is also streamlined for efficiency to eliminate waste and reduce costs while in effort to reduce and eliminate waste, products from last season are recycled or resold the next season. MUJI’s home solutions are becoming a good answer to the growing population and shrinking home space, excessive production and consumption and global warming. A globalized world is triggering interest in oriental culture and Japanese MUJI is the one stop for an eco-friendly Japanese home.

2. WEAKNESSES

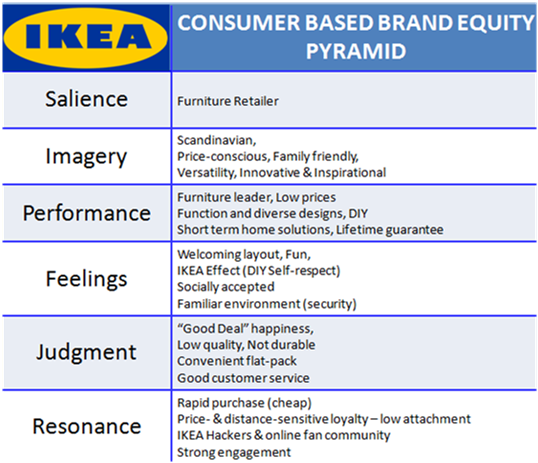

2A. LOW AWARENESS: Our brand awareness survey results revealed that the young French market does not associate furniture to MUJI at all, despite the growing amount of retail. There appears to be a correlation to the high amount of competitors, their “No-brand” strategy being ‘too successful’ and the fact that MUJI is fairly new to Europe compared to IKEA. They do know the brand but have not or hardly shop there and there appears to be a large gap in MUJI marketing efforts left to be implemented. They need to generate more ‘buzz’ and it appears word-of-mouth may not work for them in the long run.

2.B. INNOVATION DRAIN: The standard range of MUJI products leaves definitely more to be desire. The link of a creative design team such as that of IKEA is hardly natural. The simplistic designs, albeit practical and beautiful, definitely loses out to the colorful IKEA shops.

2.C. PRICING: MUJI products are generally priced higher than IKEA which is already a large losing point for the masses who do not explicitly seek self-expressionism and care for the environment. This could also why MUJI’s brand awareness is not so high amongst the young as its higher prices can lead the their shops being mistaken as boutiques. Importing from Japan is fancy but not necessarily good for integrated costs. In the current European economic slump their weakness in relatively higher pricing is evolving into a threat.

3. OPPORTUNITIES

3.A. GLOBAL EXPANSION: The Japanese market is becoming saturated for MUJI. Thankfully the no-brand trend is desirable across continents and economies. As a consequence, MUJI stands to gain by expanding globally. The Japanese brand plans to open new stores on the Canadian market in 2014. In North America, the retailer has already opened new locations in New York and Los Angeles. MUJI also plans to expand its footsteps into the Asian market especially in third largest economy of this region: India, the next target. As IKEA did, the Japanese brand will have to wait for the approval of the Indian government. Once they have it, they will partner with a local retailer. MUJI will only have 51% of the majority stake in the partnership and will handle the product line-up and store design. The growing purchase power of the middle-class segment in India presents a real opportunity.

3.B. INNOVATION COULD BRANCH OFF AS NEW SUSTAINABLE PRODUCTS: As MUJI’s strategy is to focus mainly on innovation within simplicity, finding alternative materials to replace what they currently use (plastic, polyester etc…) could be an opportunity for MUJI as it could be labelled a “truly environmental-friendly” brand. For example, it may be possible to transition their current PP Range (Polypropylene, Clear hard plastic) to utilize biodegradable plastic, wood or even cellulose. Their stationery already minimizes plastic use, and their clothing is sourced from organic cotton – they stand to differentiate themselves more by using organic cotton in all their textiles.

4. THREATS

4.A. PRICE INCONSISTENCY BETWEEN MARKETS: MUJI plans to expand on the Canadian market. However the brand faces the difficulty to align its prices with the American market, highlighted by the fact that Canadian shoppers tend to compare the prices with the U.S. In order to have lower prices on the Canadian market, MUJI will have to shrink its margin profit.

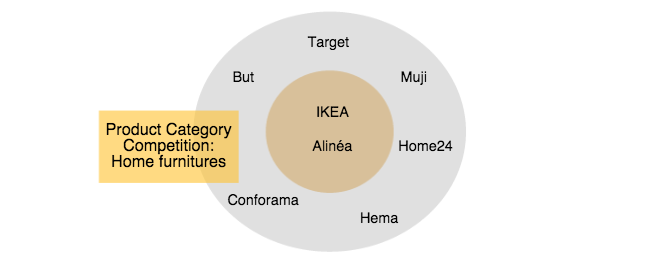

4.B. COMPETITORS: MUJI has to face competition from Uniqlo the Japanese clothing retailer and from Hema, the Dutch retailer (Read the Competitive Framework part for more details).

4.C. “NO BRAND” POLICY HAS NO MEANING IN EMERGING MARKETS: MUJI plans to enter the Indian market. However the main challenge for the minimalist brand is to convince Indian consumers with their “no brand policy” as they usually prefer logos on items. The “No Brand” policy has no more meaning first because it’s based on a reaction to the numerous brands on the market (Japan, Europe, America, Canada). Second because in this kind of emerging markets there are not so many brands so this kind of “No Brand” is not attractive and clear to customers. |

1. STRENGTHS

1.A. FURNITURE LEADER: Table 1 in the Lovemark post has uncovered the strongest advantage IKEA has is its strong brand-category association. Our brand awareness survey moreover affirmed this, with 100% of our respondent mentioning IKEA when they thought of furniture. Being a synonym to furniture means that IKEA will always be considered as a first option. Being a leader also automatically commands respect and trust, but also comes with a lot of responsibility.

1.B. NO CAP ON INNOVATION: IKEA’s target to make all innovation affordable to customers means that there is always something new in store, keeping their brand image unconventional, fresh and inspiration. Our Lovemark survey moreover affirmed this strength with ‘Inspiration’ garnering 65% of the respondents love for IKEA. It is essential that IKEA continues innovating its products and understanding their customers dreams to stay ahead of the competition.

1.C. SUSTAINABLE GOALS: IKEA’s People & Planet Positive’ strategy adopted since 2013 is reflecting well for the furniture leader in press and in its retail and this is creating a positive brand image for the Swedish giant.

1.D. AGGRESSIVE MARKETING: Whether loved or not, the IKEA Catalogue is known by all and received by all. The catalogue acts as the bible of furniture innovation and fashion and being so successful and adaptive to all countries, it markets itself further. It has branched out into many other sub-marketing opportunities such as the Instagram Challenge and IKEA is also on the forefront of connecting to customers via social media.

2. WEAKNESSES

2.A. DISLOYALTY FROM PRICE SENSITIVITY: Delivering goods at lower prices has its long term costs, in that it not only promotes a consumerist attitude, but also drives away customers should prices be increased minimally. This places IKEA in a trap of its own, frozen in a constant ‘promotion’ phase as without clearly communicating ‘savings’ to customers their appeal will drop.

2.B. QUALITY COMPROMISE: Quality is perceptive and IKEA risked a low quality image from low pricing. Our surveys revealed that IKEA is most loved for its competitive pricing but also has a negative correlation to quality. Regardless if some products are of high quality or not, perception governs reality and this has resulted in IKEA’s image for sub-quality furniture.

2.C. LOCATION DISTANCE: IKEA’s location strategy in warehouses next to highways allows larger purchases and encourages access by private transport, however alienates most ‘small purchasers’ and ‘Urbanites’ who do not wish to travel and/or have found home solutions closer to home. As more competitors enter the market, IKEA penetration in cities becomes more difficult. Location is where IKEA loses out most to MUJI. They will have to quickly build more city locations.

2.D. NEGATIVE PRESS: Distaste for mass-produced furniture and the rise of food scandals amidst an increasingly eco-conscious society overtook IKEA by surprise in the last years. Being a ‘family and fun focused’ brand, the food taint scandal in IKEA’s canteens has tarnished its image and families would refrain from feeding their children there. Outsourcing intensively from less developed countries and overproduction has also drawn negativity for being environmentally irresponsible. IKEA reacted to this movement after these incidents but unfortunately gaining back trust is a slow recovery.

3. OPPORTUNITIES

3.A. PUSHING FOR ONLINE SALES AND OPENING NEW STORES : IKEA’s main strategy was to implement its stores out-of-town. However consumer’s habits regarding shopping has changed overtime. More and more consumers go online to shop, using their mobile devices. They use multi-channel to do their shopping. As a consequence, IKEA’s strategy is to push for online sales to meet customer’s demand. The Swedish brand has 315 stores in 27 countries. However they only have websites in 13 of them. IKEA also plans to expand its “click and collect” system in which people can order IKEA’s products on the internet and collect them in other pick up points. Finally, IKEA plans to open new “City Stores” in France and Germany (IKEA’s second and third largest market) by opening stores in French and German cities.

3.B. EXPANSION INTO DEVELOPING ECONOMIES: Thanks to the increasing of retail market share in developing countries, retailers have the opportunity to expand abroad. IKEA’s strategy is to pushes for expanding internationally. The Swedish brand has already started to open new stores in China and currently plans to enter the Indian market as well as in Serbia, South Korea, and many other countries.

3.C. SUSTAINABILITY ISSUE: Sustainability became a question of urgency as climate change and scarcity of resources threat. These environmental issues have to be tackled to fulfill the objectives of the governments and international organizations. As a consequence, IKEA has decided to adopt an aggressive approach toward green issues investing in solar and wind power, buying a high proportion of its wood and cotton from sustainable sources.

4. THREATS

4.A. INTENSIFYING COMPETITION IN EUROPE AND IN THE US: IKEA has to face more and more competitors who propose a wider range of furniture, stationery products and appliances at a lower price, such as Target and Walmart in the US, and Home24, Habitat, Muji, Conforama, in Europe for example. IKEA will have to diversify its range of products.

4.B. “ONE SIZE DOESN’T FIT ALL”: As IKEA expands in developing countries and becomes more global, the challenge for this brand is to adjust to the culture of these countries. Therefore IKEA has to offer a wider range of product. Indeed consumer’s habits and way of living in emerging markets are not the same whether it is in India or in China for example. Besides the target is not the same as IKEA targets the growing middle class in these countries. Thus the conception of low price in Europe won’t be the same in emerging countries as IKEA won’t position as a cheapest brand on these markets.

4.C. SLOWDOWN IN THE CONSUMPTION: Because of the economic crisis, the household’s disposable incomes decreased. Moreover, the housing crisis, leads to less moving out from the people. As a consequence consumers spend less money on the home furniture market.

4.D. DIFFICULTIES TO ENTER NEW MARKETS: IKEA has started its horizontal integration on the Chinese market and plans to implement in other developing countries like India, Morocco and Japan for example. However the Swedish brand has difficulties to enter the Indian and Chinese market because of the regulations from these countries. As a consequence IKEA has to find agreements with these governments which will impact its business strategy. For instance, IKEA managed to reach an agreement with the Indian government to open 25 stores on its territory. As a consequence it must comply with the requirements from the Indian government which are :

- to provide from 30% of indian companies

- no e-shop,

- selling of groceries only in cafeterias

|